Government Shutdown Has You Down? Think Again!

Did you know that in actuality the government has only truly shutdown only 4 times in US history for more than 1 business day? Therefore, this is a significant issue that impacts many areas of our lives especially further loss of confidence in the US government, so let’s explore. However in order to fully understand the consequences both real and potential we have to ask ourselves WHY? Why do we have these debt ceiling issues?

Therefore I propose, a government shutdown is not the problem. Rising public debt is the problem. Massive government deficit spending to no end and now over $33T with rising interest expense over $1T especially with recent downgrades. Fitch downgrade was more significant than the media and other analysts presented it. Downgrades equal higher interest expenses on that rising debt. On my podcast with Danielle DiMartino Booth (FED Dallas insider) she rose that issue as well. Fitch downgrade was significant and most likely with more to come.

Did you know that (per CNBC) the “TREASURY TO BORROW $776 BILLION IN THE FINAL THREE MONTHS OF THE YEAR” Yes, in a closely watched announcement Monday afternoon, the Treasury Department said it will be looking to borrow $776 billion.The Treasury said it expects to borrow $816 billion between January and March. And don’t forget, the Treasury just borrowed $1.01 trillion in the recently ended July through September period, the highest ever for that quarter. Of course, there are hundreds of headlines all warning of the negative impact of a government shutdown. So let’s look at the negative impact on GDP which, according to Bloomberg, is estimated at 0.5% of the quarterly annualized rate if the shutdown lasts for two weeks. (annualized rate, not overall!) The last government shutdown lasted between 12-22-2018 – 01-20-2019, and US economy still grew at a 2.2% rate.

The Biden administration has signed a stopgap bill to prevent a government shutdown and fund the expenditures for up to 45 days if there is no agreement. However, I reiterate, the entire debate is created around the “crisis” that a shutdown would generate instead of focusing on the CAUSE: excessive deficit spending and soaring public debt.

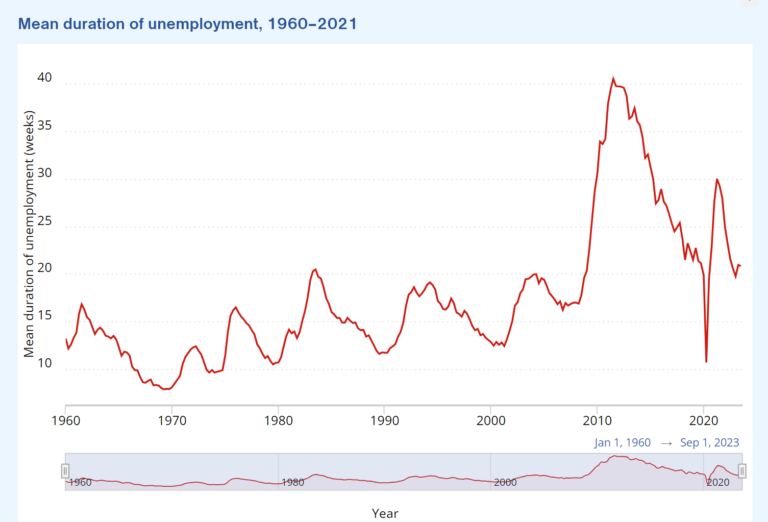

Therefore, I maintain, the problem in the US is not the government shutdown but the irresponsible and massive deficit spending that administrations continue to impose regardless of economic conditions. When the economy grows (and with almost full employment), governments announce more spending because it is “time to borrow,” (Krugman). When the economy is in recession, governments say that they need to spend even more to “save the economy.” In the process, government size in the economy increases, and record tax receipts are fully consumed in no time because expenditures always exceed revenues!That is the problem!

With the Biden administration’s own projections, the accumulated deficit between 2023 – 2032 would be over $14T US dollars (another 50% growth!), assuming that there would be no recession or employment decline (which we know is unlikely). Public debt has risen above $33T US dollars, and the budget deficit in a period of growth and strong job creation is over $1.7T US dollars. As of August 2023, it costs $808 billion to maintain the debt, which is 15% of the total federal spending, according to the U.S. Treasury. Interest rates are rising at the same time as the government rejects all budget constraints. Looks like a potential monetary catastrophy.

The only saving grace for US is the dollar being the global reserve currency with no real contenders that have even close stability or liquidity. Therefore global demand for U.S. dollars remains elevated, and the dollar index (DXY) is rising because the monetary imbalances of other nations are larger than the US challenges (lesser of the evils!), and it still maintains freedom of capital and independent institutions with high investor security. But this does not mean that the government can do what it wants!

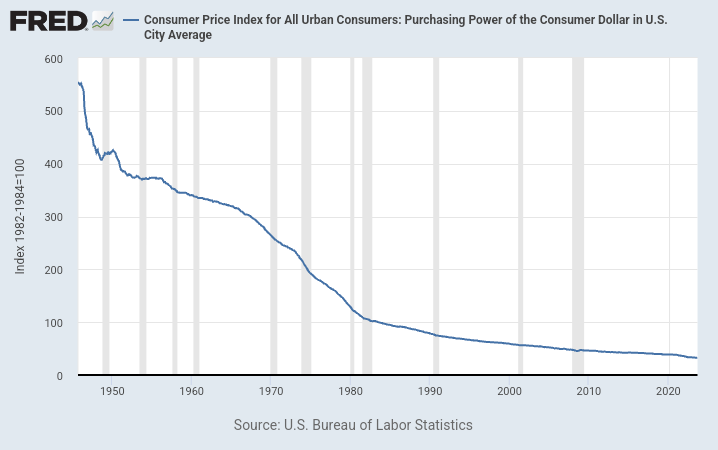

When confidence in the currency collapses, the impact is sudden and potentially catastrophic. The US rising debt and deficit irresponsibility means more taxes, less growth, and more inflation in the future. How will they repay these debts? Doesn’t seem possible. Further monetary debasement looks likely, unfortunately. Government debt is not a gift of reserves for the private sector; it crowds out the private sector and is a burden of economic problems for future generations. Sound money can only come from fiscal responsibility.

Lastly, to repeat, according to the U.S. Treasury, year-end data from September 2023 show that the deficit for the full year 2023 was $1.7 trillion, $320 billion higher than the prior year’s deficit. As a percentage of GDP, the deficit was 6.3%, an increase from 5.4% in FY 2022. This means that the US will likely post the worst GDP growth excluding debt increases since 1929, or, in other words, that the country is in a recession disguised by bloated deficit spending.It seems the US government is unable to spend less than 22.8% of GDP, and no tax revenue measure can eliminate the deficit. Raising taxes on the top earners would not eliminate the deficit (as many may believe) because how would the government collect $1.7T in additional taxes per year and every year. Regardless of what the growth of the economy is, it is not possible.

With $33.6 trillion of public debt and the administration’s own estimate of the accumulated deficit for 2023–2032, public debt is going to soar by $14T. No tax measure can eliminate that problem. Deficits are always a spending problem. Massively monetizing government spending was the cause of inflation. The excessive money growth created a persistent inflationary problem that continues to this day, even with declining monetary aggregates. This level of inflation remains because the government continues to consume an excessive amount of newly created currency units, and money market fund inflows show that the reduction in base money (M2) may be misleading to predict an abrupt fall in the interannual inflation rate. It is impossible to believe that a massive intervention from the FED would have avoided the increase in deficit, but it does not even matter. Even if there had been no rise in the cost of debt, the deficit would have remained above $1.6 trillion. Even if the tax receipts had been in line with the government’s estimate, the annual deficit would have been higher than $1.3T.High public deficits mean lower growth, lower real wages, and more debt in the future. All of it leads to higher taxes and persistent inflation.

There is no such thing as a balanced budget with ever-increasing government size and constant erosion of the private sector via higher taxes. Instead, we need to lower taxes and reduce government intervention and regulation to encourage entrepreneurship, innovation, and creativity in our society for freedom and betterment for all.